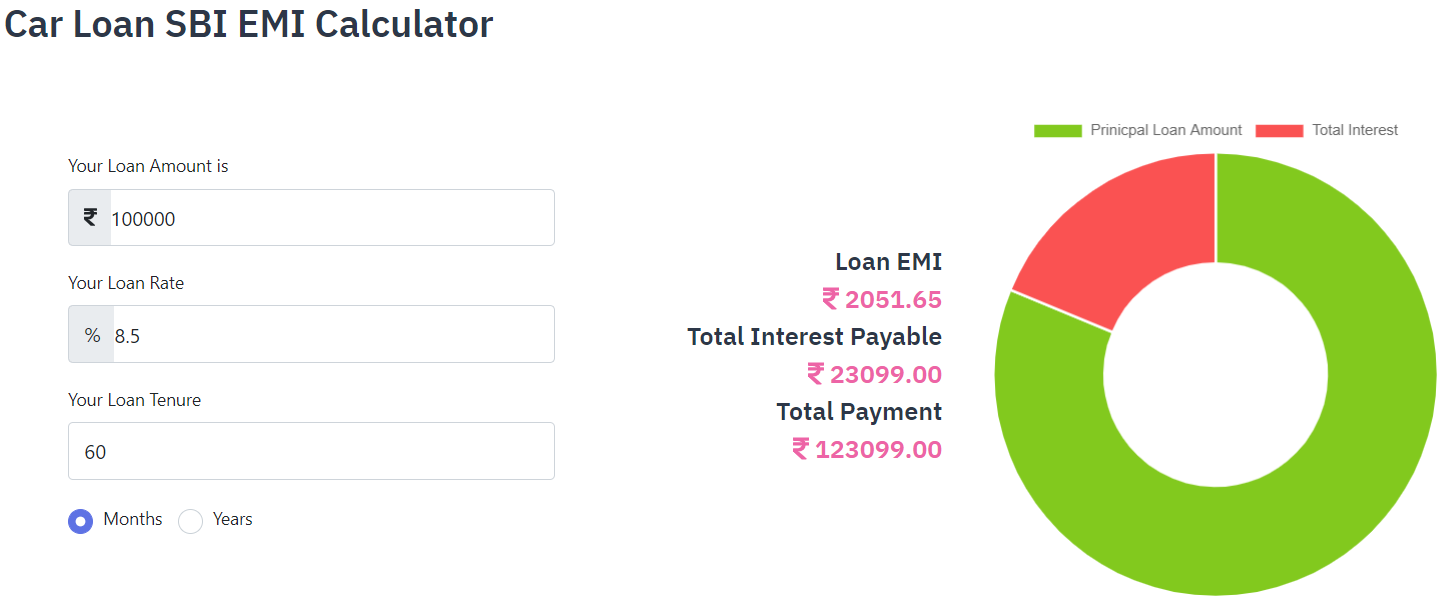

The SBI Car loan calculator allows you to calculate your EMIs by entering the loan amount, interest rate, and loan tenure. The calculator shows you the EMIs instantly and will adjust as you modify the loan. Whether you plan to pay the loan amount in three months, six months, or even one year, the SBI car loan calculator will help you make the right decision.

Interest rate

An SBI car loan is a great way to finance a new car, and you can save money by choosing a low interest rate. These loans can pay for up to 90% of the on-road price of a new car. Old cars, on the other hand, will carry a higher interest rate. Before making your decision to take out a car loan, it’s important to consider the costs and benefits of both options.

A car loan’s interest rate is calculated using Equated Monthly Instalment, or EMI. This is the amount of money you repay every month. This amount is based on your income, as well as the value of the car you wish to purchase. The higher the loan amount, the higher the EMI. Also, the longer the loan term, the higher the EMI will be.

Loan tenure

An SBI Car loan calculator is an online tool which helps you figure out how much you can borrow and how long it will take to repay it. The calculator requires a few basic details about your loan like the loan amount, interest rate and the processing fee. It can also show you what your EMI will be. You can even choose to prepay some of your loan amount to lower the total amount you’ll pay.

Another great benefit of using an SBI Car loan calculator is that you can calculate your monthly repayment amount easily. By knowing how much you’ll have to pay each month, you’ll be able to budget for other expenses. You can also plan for prepayments and preclosures, which can help you pay off your loan sooner.

Advance sum

In case you want to buy a new car, SBI offers an Advance sum that is around 85% of the on-street cost. However, this amount is subject to interest rates. The higher the rate, the larger the credit EMI and the bigger the total out-of-pocket expense of the advance. It is advisable to check rates online before applying for a car loan through SBI.

To apply for an SBI car loan, you must first have an SBI account. Once you have an account, the online application form will appear. You will have to enter your personal details and documents. You can also check your loan status on the SBI website.

Insurance premiums

You can calculate your insurance premiums easily with the SBI car loan calculator on the company’s website. This calculator will show you the premium you need to pay and give you a range of different policies. Moreover, it will allow you to pay your premiums online, through your credit or debit card. This makes the process much faster and easier, and will eliminate the need to go to an insurance agent.

SBI car loan calculator will also give you an idea of the EMI amount that you will have to pay every month. This is important to help you determine if you can comfortably pay your EMIs. You must also consider the loan tenure, as the longer the loan tenure, the higher your interest will be.

Monthly EMI

Before deciding on the EMI of your SBI car loan, it is essential to assess your monthly expenses. If your expenses are high, then you can choose to pay less on your monthly EMI. In this way, you can adjust your monthly payments to your budget. In addition, you can experiment with different loan amounts to get a better idea of the monthly EMI.

In addition to the monthly EMI, you should be aware of your credit score. A good credit score is important, as most banks would not grant a loan to someone with a low score. As such, a good credit score is mandatory for an SBI car loan.